Bench

Disclosure: This page contains affiliate links. If you buy through them, we may earn a commission at no extra cost to you. As an Amazon Associate we earn from qualifying purchases.

Appears in these guides

Review

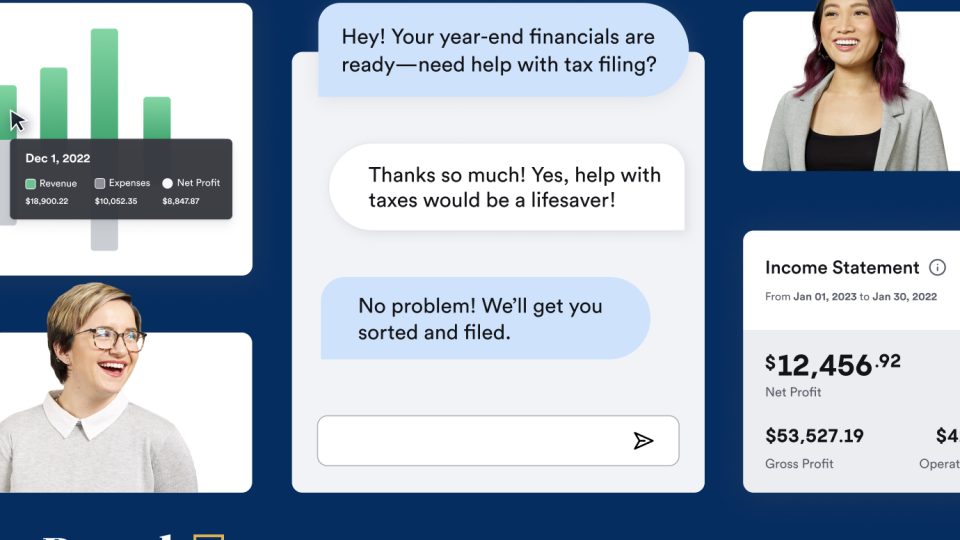

Bench is presented as an online bookkeeping service that combines software and a human bookkeeping team. It is often described as a solution for small business owners and independent professionals who want regular reconciled books without hiring an in-house accountant.

Who it is for: Bench appears suited to sole proprietors, freelancers, early stage startups, and small businesses with straightforward revenue and expense patterns. It may be most useful for owners who prefer to delegate day to day bookkeeping and focus on operations rather than learning accounting detail.

Key features commonly highlighted include regular bank and credit card reconciliation, categorized transactions, monthly financial statements, and a point of contact with a bookkeeping team. Integrations with bank feeds and the ability to upload receipts are typical parts of the offering. Exact features and service levels can vary, so confirm current details before committing.

Performance and reliability depend a lot on how consistently you provide documents and respond to questions. When input is timely, the combination of automation plus human review can produce cleaner books than fully manual approaches. Turnaround times and accuracy may vary by client complexity and the provider's workload.

Usability tends to center on a web dashboard and communication with your bookkeeping team. Many users find that a dedicated contact and a simplified interface reduce friction, but some may want more direct customization or advanced reporting than is provided out of the box.

Maintenance and ongoing use require a steady flow of bank statements, invoices, and receipts. Expect to periodically review reports, answer clarifying questions from your bookkeeper, and reconcile any unusual items. Also confirm which tax-related services, payroll support, or advisory offerings are included versus which require additional providers.

What to watch out for

- Confirm the exact scope of services and whether tax filing, payroll, or advisory work are included.

- Watch how add-on services and custom requests are priced.

- Assess whether the service can scale with rapid growth or more complex accounting needs.

- Expect turnaround times to depend on your responsiveness and the vendor's capacity.

This review was drafted by AI and should be verified with the vendor before making decisions.

Pros

- Monthly reconciled financial statements delivered by a bookkeeping team

- Simplifies bookkeeping for small business owners with limited accounting time

- Centralized dashboard for basic financial visibility

- Dedicated point of contact for questions and clarifications

Cons

- May not cover tax filing or payroll without add-ons or partner services

- Less suitable for high transaction volume or complex accounting needs

- Limited advanced report customization compared with full-service accountants

- Ongoing effectiveness depends on timely submission of documents